An Unbiased View of Multi Peril Crop Insurance

Wiki Article

The Facts About Multi Peril Crop Insurance Uncovered

Table of ContentsMulti Peril Crop Insurance Fundamentals ExplainedOur Multi Peril Crop Insurance IdeasGet This Report about Multi Peril Crop InsuranceGetting My Multi Peril Crop Insurance To WorkSome Ideas on Multi Peril Crop Insurance You Need To Know

Ranch and cattle ranch residential or commercial property insurance policy covers the assets of your farm as well as ranch, such as livestock, devices, structures, installations, and others. Think about this as business residential property insurance policy that's solely underwritten for businesses in agriculture. These are the typical coverages you can receive from ranch as well as ranch building insurance coverage. The tools, barn, equipment, equipment, animals, materials, as well as maker sheds are beneficial possessions.Your ranch and cattle ranch makes use of flatbed trailers, enclosed trailers, or utility trailers to transport items as well as tools. Commercial auto insurance coverage will cover the trailer but just if it's affixed to the insured tractor or truck. If something takes place to the trailer while it's not attached, then you're left on your very own.

Workers' payment insurance policy gives the funds an employee can make use of to buy drugs for an occupational injury or disease, as prescribed by the medical professional. Workers' compensation insurance policy covers rehab. It will certainly likewise cover re-training costs to ensure that your staff member can resume his job. While your employee is under rehab or being educated, the plan will certainly provide an allowance equal to a percent of the average regular wage.

You can insure on your own with workers' compensation insurance coverage. While acquiring the policy, service providers will certainly provide you the freedom to include or omit on your own as a guaranteed.

Not known Details About Multi Peril Crop Insurance

To obtain a quote, you can collaborate with an American Family members Insurance representative, conversation with representatives online, or phone American Family members 24-hour a day, 365 days a year. You can file a claim online, over the phone, or directly with your representative. American Household has actually stayed in business since 1927 and is trusted as a company of insurance coverage for farmers.And also, there are a couple of various kinds of ranch truck insurance plans offered. The insurance coverage requires for each kind of lorry vary. By investing just a little time, farmers can increase their understanding about the various types of farm vehicles as well as choose the very best as well as most cost-effective insurance coverage services for each and every.

Lots of ranch insurance coverage carriers will certainly likewise offer to create a farmer's car insurance coverage. In some situations, a ranch insurance coverage provider will only provide specific kinds of auto insurance or just guarantee the vehicle dangers that have procedures within a specific scope or scale.

Regardless of what provider is composing the farmer's car insurance plan, heavy and extra-heavy trucks will require to be placed on a industrial vehicle policy. Trucks labelled to an industrial farm entity, such as an LLC or INC, will certainly require to be put on a business plan despite the insurance coverage provider.

The Best Guide To Multi Peril Crop Insurance

If a farmer has a semi that is utilized for carrying their very own farm items, they may be able to include this on the same commercial auto plan that insures their commercially-owned pickup. However, if the semi is utilized in the off-season to haul the goods of others, the majority of standard farm and also industrial auto insurance policy carriers will not have an "appetite" for this kind of risk.

A knowledgeable independent agent can aid you understand the kind of plan with which your business automobile need to be insured and discuss the nuanced implications and insurance policy ramifications of having multiple automobile policies with various insurance coverage service providers. Some vehicles that are utilized useful link on the farm are guaranteed on personal automobile plans.

Multi Peril Crop Insurance Can Be Fun For Everyone

Several farmers delegate older or limited usage lorries to this sort of enrollment since it is an economical means to keep a lorry in operation without all of the added expenses typically connected with automobiles. The Division of Transportation in the state of Pennsylvania categorizes several different kinds of unlicensed farm vehicles Type A, B, C, as well as D.Time of day of use, miles from the residence ranch, and other restrictions relate to these kinds of cars. It's not this contact form a good idea to delegate your "daily chauffeur" as an unlicensed ranch lorry. As you can see, there are multiple kinds of farm vehicle insurance plan offered to farmers.

It is very important to review your vehicles and their usage freely with your agent when they are structuring your insurance policy portfolio. This kind of in-depth, conversational technique to the insurance acquiring procedure will assist to make sure that all coverage voids are closed and also you are receiving the biggest worth from your plans.

The Buzz on Multi Peril Crop Insurance

Disclaimer: Info and cases offered in this material are implied for interesting, illustratory objectives as well as ought to not be taken into consideration legally binding.

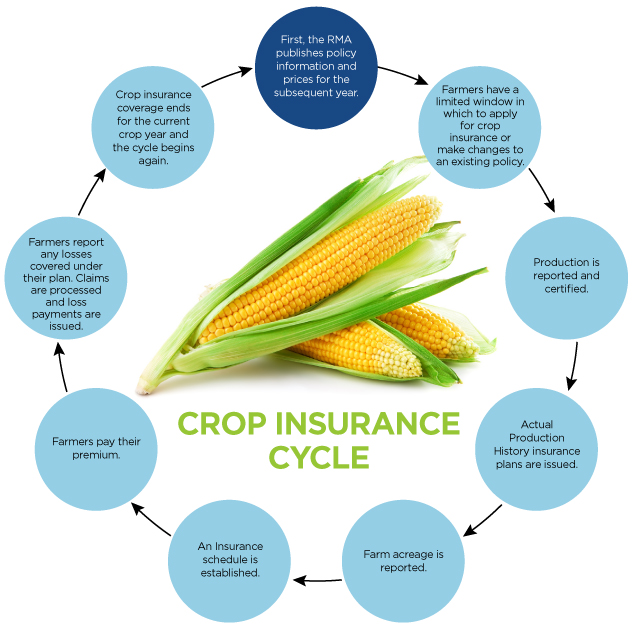

Unlike various other sorts of insurance coverage, crop insurance policy hinges on well-known days that relate to all policies. These days are determined by the RMA in advance of the growing season and published on its website. Days vary by crop as well as by county. These find more info are the crucial dates farmers must expect to satisfy: All crop insurance applications for the assigned county and also crop schedule by this day.

Report this wiki page